We are the 0.01%?

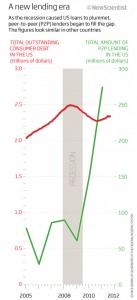

New Scientist has an interesting article on peer-to-peer lending, a crowd-sourced alternative to borrowing from banks. Unfortunately, it’s illustrated by an extremely misleading graph.

The graph title says ” As the recession caused US loans to plummet, peer-to-peer lenders began to fill the gap”, and the graph certainly makes the rise in peer-to-peer lending (green) look dramatic compared to total US consumer debt (red). However, the axis scale for the green line is 10,000 times smaller than for the red line. The point where the red and green lines cross is where peer-to-peer first reached 0.01% of all consumer lending.

If the two lines used the same y-axis scale, the green line would be horizontal and indistinguishable from the zero line. Perhaps peer-to-peer lenders “began” to fill the gap, but they will have to expand a thousand fold before they are even visible on the same scale as total US consumer debt.

Thomas Lumley (@tslumley) is Professor of Biostatistics at the University of Auckland. His research interests include semiparametric models, survey sampling, statistical computing, foundations of statistics, and whatever methodological problems his medical collaborators come up with. He also blogs at Biased and Inefficient See all posts by Thomas Lumley »