Lotto, luck, and risk perception

There’s a big Lotto jackpot today, so it is my duty as a statistician to write something about how people misunderstand probability. I don’t make the rules.

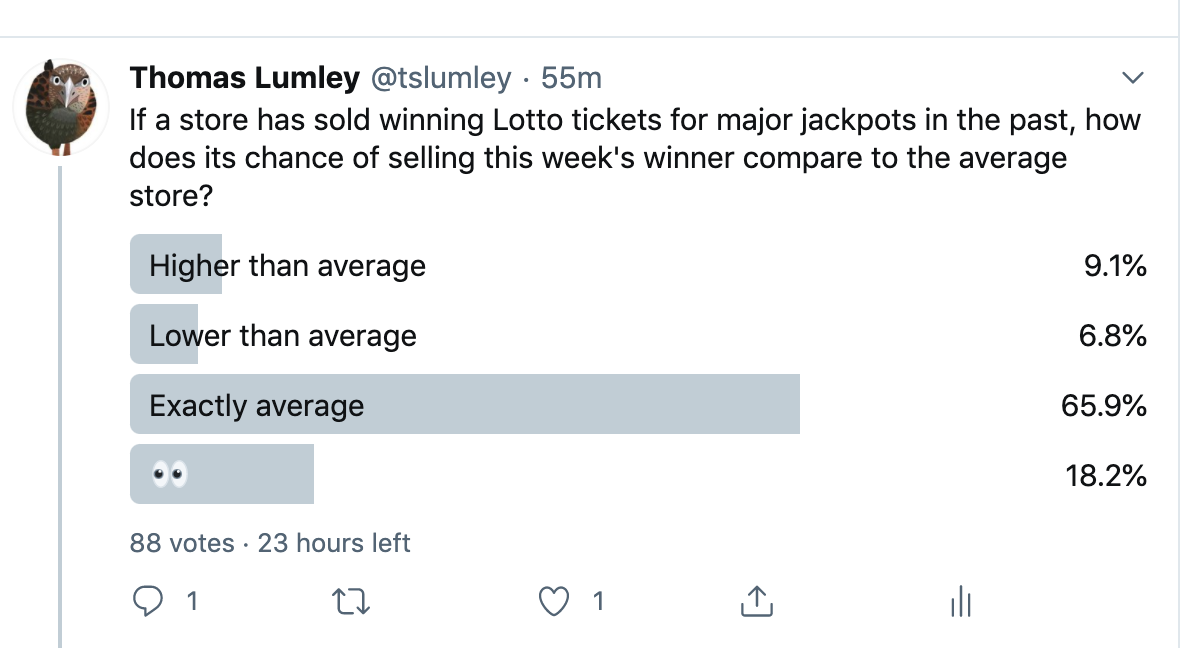

So, last week, I did a bogus poll on Twitter

The results don’t tell you anything about any useful population, because it was a bogus poll on Twitter, but it’s still interesting how many responses fell into the trap.

Last week, we had headlines about ‘lucky’ stores to buy Lotto tickets. Now, as you know, the probability that one of your chosen combinations wins does not depend at all on where you bought the ticket, or how you chose the numbers. However, it is true that a shop which has sold winning tickets in the past is more likely to sell winning tickets in the future. Selling a winning ticket in the past is more likely for an outlet that sells lots of tickets, and an outlet that sells lots of tickets is more likely to sell winning tickets in the future. On top of that, it appears that people like to buy their tickets from outlets that have sold winning tickets in the past, which will increase the sales and therefore increase the number of future winners. It doesn’t help the gamblers, but it does help the outlet.

In fact, saying it doesn’t help the gamblers isn’t quite correct. You’d hope, given the odds, that many people buying Lotto tickets were doing it primarily for entertainment (the cash return on tickets is negative, but that’s also true of beer and movies and rugby games and restaurant dinners). Given that, anything that increases the entertainment value helps the gamblers, and buying from a ‘lucky’ store could count as a plus.

I also want to talk about a story in the Herald. It’s good on the odds of winning and the impact of a ‘must win’ draw — and quotes Dr Matt Parry, from Otago, which is generally a good indicator. However, a separate part of the story says

Your chances of winning Powerball – one in 38 million – are less likely than you being struck by lightning – one in 280,000 – on your way to buy the ticket.

That seems not just wrong but incredibly wrong. The story says “[m]ore than 1.9 million tickets were sold for the previous $50m must-be-won Powerball jackpot” (and that’s tickets, not lines), so at one in 280,000 we’d expect six or seven people to have been struck by lightning on their way to buy tickets. According to this Radio NZ story, there were 13 ACC claims for lightning injury in 3 years, and while that would leave out fatal injuries, the story also says a minority are fatal. There’s no way you have a 1 in 280,000 chance of being struck by lightning on a routine shopping trip.

So where does this number come from? Well, the US also has a Powerball lottery, which has even lower odds of winning: one in 292 million. And there are news stories there with vaguely similar numbers.

The odds of grabbing the grand prize are 1 in 292.2 million, according to the game’s own assessment. To put this in context, your chances of being killed by a lightning strike are approximately 1 in 161,000. The odds of being killed in a shark attack are 1 in 3.7 million.

Even getting hit by a meteorite is more likely than winning the Powerball — 1 in 1.9 million.

The lightning-strike number looks to be a lifetime risk in the US, where lightning is more common than New Zealand, not the risk per shopping trip.

There are other problems with the numbers. The 1 in 1.9 million for getting hit by a meteorite is staggeringly wrong given that only one person in US history has been hit by a meteorite, back in 1954.

How did the 1 in 1.9 million figure get past editing? Well, it probably wasn’t checked, but there is a related number that’s arguably correct. If you calculate the probability of dying due to a meteorite impact, you have to consider the entire range of impacts from something the size of a golf ball up to a significant asteroid. The dinosaurs were wiped out (in part, probably) by an asteroid impact, 66 million years ago, so it would be reasonable to assume a risk in the ballpark of 1 in 100 million per year, giving a lifetime risk of experiencing the impact for an individual of one in a million or so. Putting that together with expected deaths from a major impact, it’s not unreasonable to get a 1 in two million risk for an individual of dying because of an asteroid impact. On the other hand, that’s not getting hit by a meteorite, and they shouldn’t be giving the number to two digits accuracy when even the order of magnitude must be uncertain.

So, if you’re in New Zealand and doing a careful risk assessment before buying a lottery ticket today, you probably don’t need to worry about lightning or low-flying rocks, but you should wear a mask. And if you’re in Auckland, maybe go to a local store or buy online.

Thomas Lumley (@tslumley) is Professor of Biostatistics at the University of Auckland. His research interests include semiparametric models, survey sampling, statistical computing, foundations of statistics, and whatever methodological problems his medical collaborators come up with. He also blogs at Biased and Inefficient See all posts by Thomas Lumley »

Just to note the 1 in 38m is the odds of getting all the numbers from any one line – on a must win the odds of winning are 1 in (# lines) – given 1.9m tickets last time, that would be more like 1 in 19m (10 lines / ticket average).

Also it’s only guaranteed to be a negative return if the combinations are spread reasonably evenly (noting 1-2-3-4-5-6 is taken by over 100 people and >31 isn’t taken t=by those using birthdays etc). It would be interesting to know if any numbers might have an expected return above 0.

4 years ago

Yes, in principle. However, I think I have read (though I can’t find the source right now) that the majority of NZ Lotto tickets are randomly generated. If so, that would reduce the potential leverage enormously.

Also, the advantage (to the extent that it exists) would only remain as long as it isn’t exploited it to any significant extent, so there’s a game theory argument that you can’t have much of positive expectation.

4 years ago

Some years ago (actually some decades ago) all the winning numbers were above 31. There were over thirty winners (IIRC 34 winners who got $38K each). Thus, it would appear that too many people exploit the ‘advantage’ making it counter-productive. Of course, people might have changed after that experience, but I think something similar happened a few years back.

4 years ago