Real estate and non-resident investors

Stats New Zealand have released the first full quarter of real-estate transfer data since the introduction of restrictions on purchases by non-residents (except for Australians and Singaporeans).

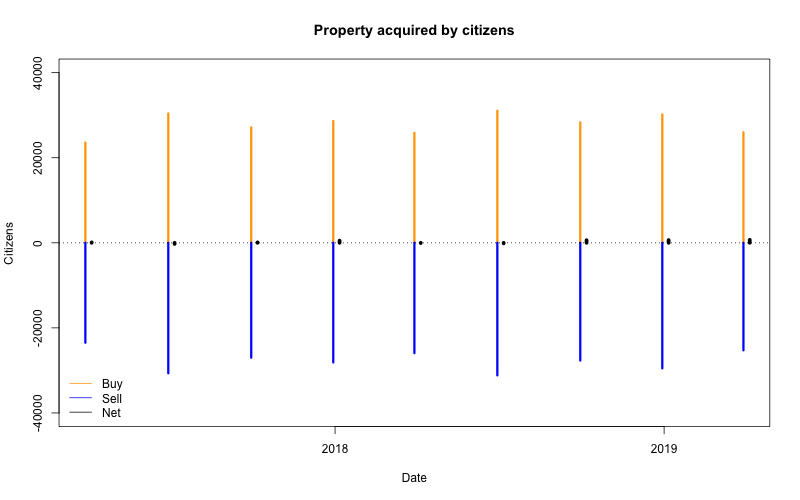

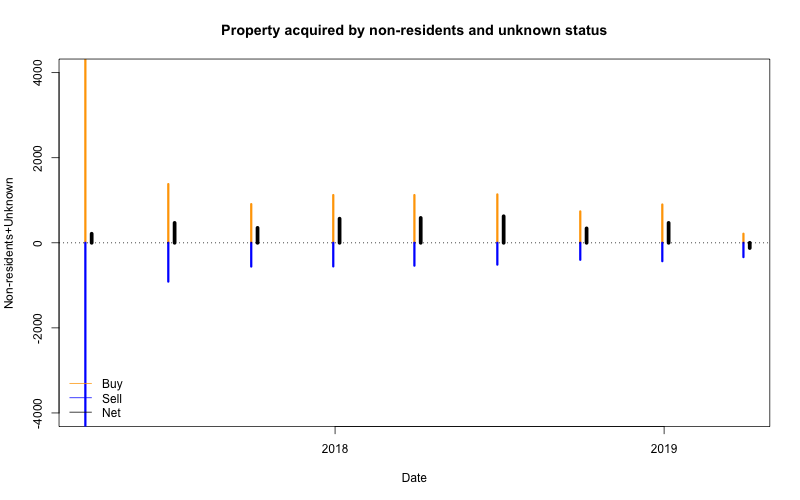

There are few stories talking about the fall in sales. The data include residence information on the seller as well as the buyer, so I made some graphs showing how the net transfers have changed over time. In all these graphs, the orange line is the number of buyers in the group, the blue line is the number of sellers, and the black line is the difference: the flow of real estate towards the group

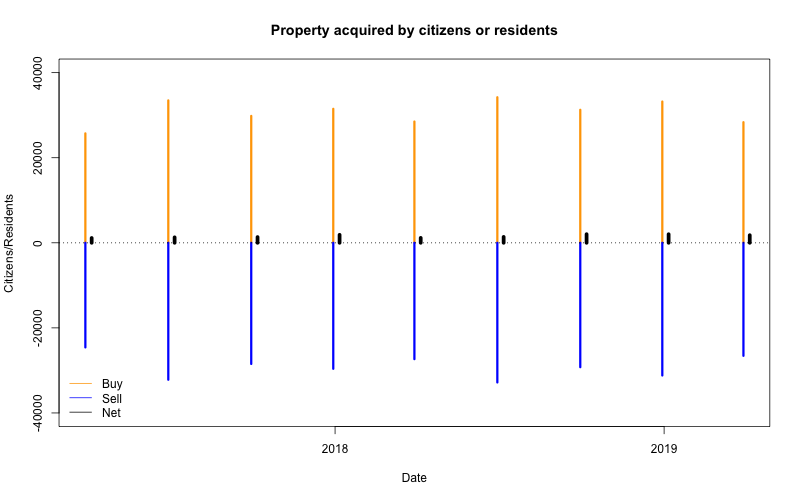

First, citizens.

Now citizens or people with residence visas. There’s almost perfect cancellation, but a slight flow of properties towards people identified as citizens or residents — not only this quarter, but for the whole time range.

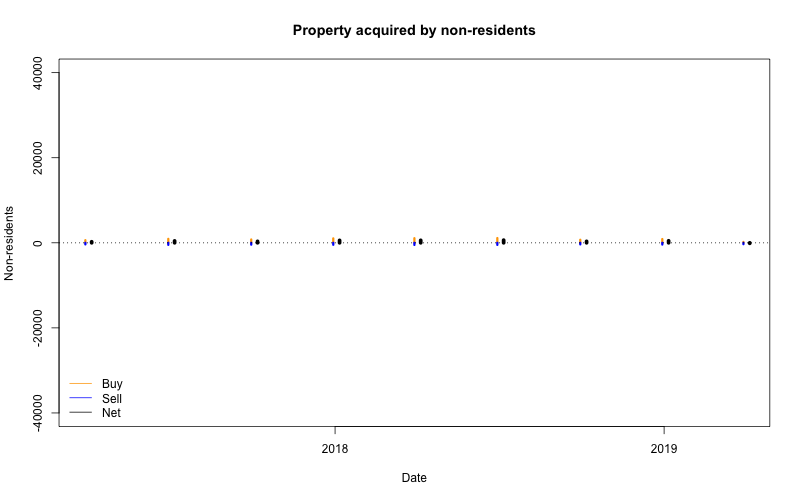

On this scale, non-residents are basically invisible

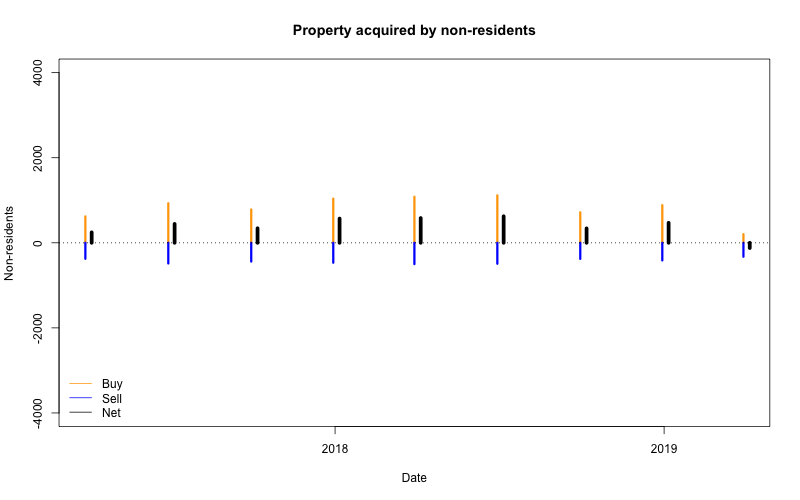

On this scale, non-residents are basically invisible  Zooming in by a factor of ten, the net acquisition by non-residents was positive until this quarter, but roughly half the gross numbers that were usually quoted. This quarter it was negative.

Zooming in by a factor of ten, the net acquisition by non-residents was positive until this quarter, but roughly half the gross numbers that were usually quoted. This quarter it was negative.

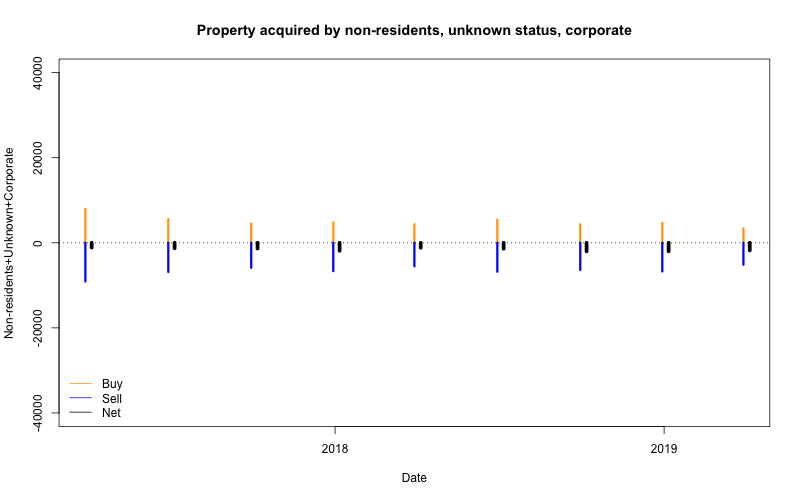

Some buyers or sellers had unknown residence status, though the numbers fell markedly after the start of 2018. Adding these to the non-residents doesn’t make a big difference.

Some buyers or sellers had unknown residence status, though the numbers fell markedly after the start of 2018. Adding these to the non-residents doesn’t make a big difference.

Residence isn’t well-defined for corporate buyers — you could be overseas and own an NZ trust. Some people add all this group to the ‘non-residents’. We now have to zoom back out to the original scale. Interestingly, the net transfer here is negative — if you’re the sort of person who thinks overseas ownership is bad, treating all corporate ownership as foreign isn’t any sort of conservative or ‘worst-case’ analysis.

Thomas Lumley (@tslumley) is Professor of Biostatistics at the University of Auckland. His research interests include semiparametric models, survey sampling, statistical computing, foundations of statistics, and whatever methodological problems his medical collaborators come up with. He also blogs at Biased and Inefficient See all posts by Thomas Lumley »

I guess the thing is of most interest is what’s going on in Auckland because this is where all the uproar started. And, perhaps, not all sales in a year but the last sale of a property in a year. Some of the NZ resident sales are just dummy sales and flips so it’s comparing apples and oranges.

5 years ago

That’s why the net figures are so much more useful than the gross ones people usually quote.

5 years ago

Stats says more concisely about the data numbers

“Not all transfers involve a sale. Land Information New Zealand estimates that approximately half of all property transfers involve a residential sale. The other half includes a very wide range of activities such as deceased estates, trustee changes, marriage settlements, boundary changes, changes to the proportions of shares of ownership, as well as sales involving non-residential property.”

It sounds like you would have to reduce your numbers in resident situations by ‘half’. I have also seem commentary that shows in Auckland ( especially Central Auckland) and Queenstown are places where foreign non residents are more significant.

5 years ago

Yes, it would have been nice to see net numbers for Auckland.

5 years ago